Using expense tracking software to record, organize, and manage your personal and business expenses will save you a lot of time and money come tax day.

But which expense tracking software should you use? What if you need to track mileage? Or save scans of receipts?

We've rounded up the best expense tracker apps to scan receipts, track expenses, and log miles. Before we get to them, let's talk a little about why you should track your spending in the first place.

If you're going to be tracking IRS expenses, it's a good idea to use expense tracking software. (Unfortunately, your personal budgeting app 5 Simple iPhone Budget Apps to Track Your Spending 5 Simple iPhone Budget Apps to Track Your Spending Apps like Mint and Goodbudget have extensive features to help you stay on track, But what if you don't need or want all of those bells and whistles? Read More

You could just keep paper receipts, but using an expense app will make the process easier. If you're going to deduct expenses on your taxes, there's a good chance you'll be collecting many different types of receipts from all kinds of vendors.

Medical, moving, and education expenses are common. Small business owners can also track moving expenses, business purchases, health insurance premiums, and more.

Using the right expense tracking software will help you store, classify, and retrieve the receipts you racked up throughout the year.

And if you've ever been audited by the IRS with no receipts to show, you know how much it's worth. Even if you haven't, saving those receipts will save you money. It's worth the little effort it takes.

There are many possible tax deductions for expenses, and figuring out if you're eligible for them can be a hassle. It might be best to track your expenses for any possible deductions and find out if you're eligible later.

On the other hand, if you're using a financial advisor or tax preparer When to Hire a Financial Advisor (and Where to Find One) When to Hire a Financial Advisor (and Where to Find One) Hiring a financial advisor can be expensive. But there are some times when it pays off here. Here are five of those moments, plus resources for finding the best professional for your situation. Read More

Here are some of the more common deductions you'll need to keep receipts for:

There are others too. To see if there are any deductions you may be taking advantage of, check out the IRS Credits and Deductions for Individuals page. If you think any of these deductions might apply to you, it's a good idea to start saving your receipts today.

If you're a business owner, there's a business credits and deductions page to help.

In addition to digital copies of receipts, you must keep physical receipts for three years.

So why, if you're keeping physical copies, should you use expense tracking software? Because it makes your life so much easier. You won't need the physical copies unless you're audited, and your expense tracking app will speed up the tax filing process.

The best expense tracking software for your particular situation depends on whether you track as an individual or as a business owner. Self-employed individuals and business owners generally need to track more expenses and may need more organizational features from their app.

People, on the other hand, probably won't keep too many receipts. There are, of course, exceptions. If you think you'll need a lot of receipt scanning power, be sure to check out the business section below.

First, though, we'll start with apps to track people's mileage and expenses.

Expensify is one of the best apps to track mileage and receipts, no matter if you are a low-spending person or a worldwide executive. Its free version is ideal for people who need 10 receipt scans or less each month.

SmartScan extracts the relevant information from each receipt and stores it on Expensify's servers, where you have unlimited storage space. When tax season rolls around, you have everything you need right at your fingertips.

If you start to need more than 10 scans per month, you can upgrade to the team plan, which we'll cover next.

Download: Expense for iOS | Android (Free)

Receipts by Wave, like Expensify, pulls the relevant information from your receipt scans, which is great for expense tracking. But it also allows you to forward email receipts to an email address where you'll also enter that information into your account.

Few people only have paper receipts, so this feature can save you a lot of time.

And Wave is totally free unless you want to process payroll or credit card payments (which, if you're not self-employed or a business owner, you probably won't). It's hard to beat that.

Download: Wave Receipts for iOS | Android (Free)

Mileage tracking can be a pain. Independent contractors, salespeople, executives, and other professionals might drive thousands of miles in a year and need to record all of those trips. MileIQ is one of the best mile tracking apps because it's almost completely automated.

The app knows when you are driving and runs in the background to track your mileage. When you've finished your trip, swipe right for business trips or personal trips. You can also use its customization features to make registration and categorization even easier.

With 40 free unit registrations per month, many people can use the app without paying. You can also pay $60 per year to get the Premium version, which gives you unlimited mileage tracking. (Interestingly, if your company has an Office 365 Business or Business Premium subscription, you can get MileIQ for free.)

Download: MileIQ for iOS | Android (Free)

Because it's a full-featured accounting app for businesses, QuickBooks has robust expense tracking features (It's also the best accounting software for freelancers. The best accounting software every freelancer needs. The best accounting software (expensive and even a crime. If you're tired of manual accounting, try accounting software. Read More). Expenses are easily categorized so you don't have to categorize them at tax time to determine where they should be deducted.

QuickBooks learns to automatically classify transactions over time, saving you the time and effort of manually entering them. You can even customize your expense categories if your accountant needs additional information.

Mobile apps let you attach receipt images to transactions on the go, and the self-employment plan lets you track mileage, too. There is no free version of QuickBooks, but you can get started with $5 per month on the self-employed plan or $7 per month with Simple Start.

The biggest advantage of using QuickBooks as your expense tracking software is that it gives you everything you need to keep track of your business.

Download: QuickBooks for iOS | Android

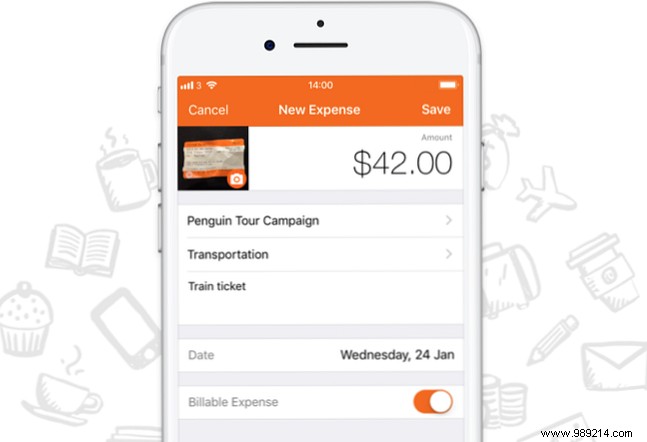

Harvest is best known as a time tracking tool The best time tracking app for Android, iOS and desktop The best time tracking app for Android, iOS and desktop We show you how time tracking can benefit you or your team, what to watch for time tracking software, and the best cross-platform app we could find for the job. Read More You can take a quick photo of a receipt to record the expense, and you can even mark it as billable to include on the customer's next bill.

Because it integrates with QuickBooks, you can import your expenses and have them ready to deduct when tax season rolls around.

You can use Harvest for free for up to two projects. If you want to include more projects, you're looking at $12 per month, which is more than many of the other options available. That said, it gives you great time tracking features and even allows you to send invoices and quotes.

Download: Harvest for iOS | Android (Free)

It may seem like a hassle, but using an app to track mileage, receipts, and other expenses will save you money in the long run. And with a plethora of expense-tracking app options, there's no reason not to get started right away.

The earlier you start, the easier it will be when tax day comes around next year. The best strategies to claim a tax return this year. The best strategies to claim a tax return this year. Nobody likes to pay taxes. But we have to. Good tax software can not only help you file taxes effortlessly, but can also minimize your tax burden at times. Read more.