Accounting is difficult for anyone. Top 12 Online Accounting Courses to Bridge Your Skills Gap. Top 12 Online Accounting Courses to Bridge Your Skill Gap. business. Read More There are so many taxes to pay, taxes to claim The best strategies to claim a tax return this year The best strategies to claim a tax return this year Nobody likes to pay taxes. But we have to. Good tax software can not only help you file taxes effortlessly, but can also minimize your tax burden at times. Read More

Worst of all, breaking the rules can be costly, stressful, and sometimes even criminal.

Fortunately, we no longer need to rely on manual accounting. Instead, there are plenty of accounting apps vying for your attention. In this article, we round up some of the best. Every application we cover has at least one unique strength.

“The most intuitive professional-grade application on the market.”

If you're a freelancer just starting out looking for accounting software, you'll no doubt see the same two names popping up over and over again:Xero and QuickBooks. The two apps are direct competitors and have very similar feature sets. Let's take a closer look at Xero 5 ways Xero can help with your finances 5 ways Xero can help with your finances Bookkeeping can be confusing, time-consuming and (if you have to pay a professional accountant) expensive. Read more.

The cloud-based company offers three price points; Starter for $9 per month, Standard for $30 per month, and Premium for $70 per month. The right plan for you depends on the scale and scope of your freelance business.

For people who only have to send a couple of invoices a month, the starter plan is suitable. It restricts you to five invoices and/or quotes, five invoices and 20 reconciled bank transactions. The Standard and Premium plans offer unlimited invoices, invoices, and reconciliations. Premium is the only plan to support multiple currencies.

From a features standpoint, it's hard to think of anything freelancers would want that isn't already included. The app allows you to accept payments, manage contacts, control inventory, pay bills, create purchase orders, track time sheets, and much more. Unfortunately, payroll administration is not yet available in all US states.

It's also great from a tax perspective. You can calculate taxes on the go as you work, and you can create and submit W2 and 1099 forms right from the app.

Finally, the software can easily connect with other applications that are part of your freelance professional life. How apps can help any independent or small business owner. Be productive. How apps can help a small or freelancer. that it can improve your productivity as a freelancer or small business owner; let's find the best of them Read More

Oh, and it's worth mentioning that Xero has a handy tool for importing your data if you're switching from QuickBooks.

“A powerful free app for new freelancers..”

If you're just beginning your journey on your own, Xero's $9 starter pack might seem like an unnecessary luxury.

Instead, why not try Wave? The multifaceted software specializes in accounting, billing, payments, payroll, recurring billing, and receipt management. And the best part? The accounting, billing, and receipt management app portions of the app are completely free to download and use.

The app offers additional services that it charges on a pay-as-you-go basis. If you are located in the United States, these add-ons include credit card processing, bank payment processing, and payroll administration. Most European countries can only use bank payments.

The accounting part of Wave is managed through an intuitive panel. It will do everything from monitoring your tax situation in real time to providing charts and graphs about your current finances. You can also use the dashboard to generate instant reports on profit and loss, sales tax, and account balances.

And even though the app is free, it still has high-quality security measures. They include 256-bit encryption and PCI Level-1 certification..

“An application adapted to non-expert British and American users..”

Although Xero offers an excellent series of tutorials and help files, there is no denying that the almost endless features can be a bit overwhelming for non-experts. If you're a freelancer, you don't want to be stuck for days fiddling with your accounting app - time and money have been wasted.

FreeAgent positions itself as an application for beginners. That's not to say it's feature-poor, but the app's language and design are explicitly aimed at people who can't tell a balance from a bill. 6 Easy Tools For People Who Hate Managing Finances 6 Easy Tools For People Who Hate Managing Finances Do you hate managing your finances? Does writing a budget fill you with dread? Take a look at these simple tools that make the process much easier and more fun. Read more.

For example, there is no indication of accounting terms such as "Accounts Receivable" or "Accounts Payable." Instead, you'll see headings like “Work” and “Expenses.”

Like most cloud-based accounting apps, title information is delivered through a dashboard. It gives you tax deadlines, real-time reports, timesheet summaries, and more.

The entry level package is £14.50/month in the UK and $12/month in the US.

“Low-cost free accounting without cloud features.”

All the apps we've seen so far are feature-rich, but that's not right for everyone. If you just want an easy way to keep track of your income and expenses, VT Cash Book is the app for you.

The app only has five functions:

It's rudimentary, but it's efficient. And it's totally free. If you're running a simple freelance operation, an application as basic as VT Cash Book might be all you need.

“A good alternative to Xero, but more confusing..”

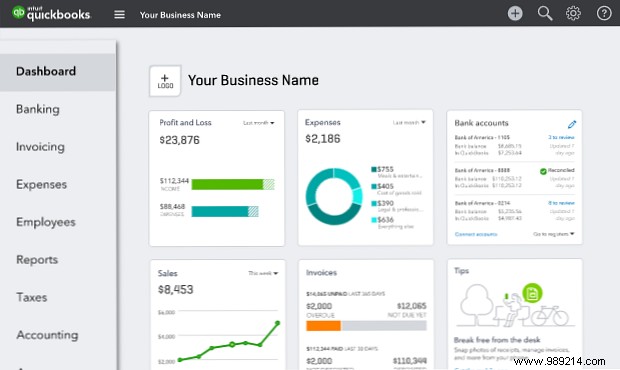

We touched on QuickBooks earlier in the article and have covered the application in detail elsewhere on the site QuickBooks Online:Easy, Reliable Cloud Accounting So You Can Focus On Your Business QuickBooks Online:Easy, Reliable Cloud Accounting So You Can you can focus on your Business QuickBooks has an established reputation as the leading all-inclusive accounting and finance service for businesses of all sizes. Read more . Battle Xero for the number one spot in the world of cloud-based accounting applications. The app debuted in 2002 with an online version two years later. Desktop and online versions are still available.

The software is impressively powerful. Cuenta con facturas personalizables, contabilidad de doble entrada, administración de inventario, soporte de nómina y múltiples monedas..

Una actualización reciente vio la llegada de un sistema de gestión de proyectos muy solicitado, aunque muchos usuarios se mostraron descontentos al descubrir que se produjo a costa de una función de gestión de la hoja de tiempo recortada..

Los usuarios de mucho tiempo también critican la interfaz de usuario. QuickBooks se basó en su reputación de ser intuitivo y fácil de usar, pero ya no es el caso. Si nunca ha usado software de contabilidad, la aplicación es desalentadora..

Al igual que Xero, QuickBooks viene con tres niveles de precios. Le costará $ 15 / mes para Simple Start hasta $ 50 / mes para el paquete Plus. Simple Start no le permite crear facturas recurrentes ni administrar facturas de proveedores.

“Un feliz compromiso entre complejidad y características..”

FreshBooks probablemente ocupa el tercer lugar en la lista de los mejores programas. No es tan popular ni tan rico en funciones como Xero y QuickBooks, pero gracias a un rediseño de 2016, es definitivamente más fácil de usar que los dos líderes del mercado..

El rediseño no fue sin sus inconvenientes. La empresa se centró en gran medida en una interfaz mejorada y en la facilidad de uso, y tuvo que hacer algunos sacrificios. Como tal, si necesita funciones como estimaciones, administración de inventario, informes financieros extensos, portales de clientes y capacidades detalladas de seguimiento de tiempo, probablemente esta no sea la aplicación para usted..

Las características antiguas todavía están disponibles en la interfaz clásica, pero el soporte para ellas está disminuyendo lentamente.

Desde un punto de vista puramente contable, también está rezagado con respecto a Xero y QuickBooks. No ofrece contabilidad de doble entrada y solo admite servicios limitados de conciliación bancaria. Sus puntos fuertes están en la facturación, facturación y gestión de clientes..

El paquete Lite de nivel de entrada cuesta $ 15 / mes, pero solo puede facturar a cinco clientes activos. El plan Premium de gama alta por $ 50 / mes aumenta el límite a 500.

Las seis aplicaciones que hemos cubierto tienen sus propias fortalezas y debilidades. Más importante aún, cada uno está orientado hacia un tipo diferente de usuario.

Por suerte, todas las aplicaciones de pago ofrecen pruebas gratuitas. Asegúrese de probar algunos de ellos antes de comprometerse con un plan de pago.

¿Qué aplicaciones de contabilidad agregarían a esta lista? ¿Qué características únicas los hacen tan especiales? Como siempre, puedes dejar todas tus opiniones y sugerencias en los comentarios a continuación..