As an employee, you have many rights and obligations. You will find a lot of essential information about your rights and obligations as a worker, as well as advice for your career or for your personal development.

To protect against daily risks, it is strongly recommended to take out home insurance. This insurance will cover the financial consequences of the damage you may cause to third parties as well as damage affecting your property and its contents. However, home insurance can weigh heavily on your budge

The burglary affects thousands of homes in France according to the Ministry of the Interior. In order to avoid this, more and more French people are equipping themselves with an anti-intrusion alarm. This device has a dissuasive effect and is really effective when its installation is well studied.

Company housing is housing allocated by the company to an employee, for which it pays part or all of the rent. Like any accommodation, company accommodation is exposed to risks, which justifies the use of home insurance? What guarantees should be included in this cover? How to find home insurance a

Depending on the risks to which the accommodations are exposed, insurance companies offer tailor-made protection on a case-by-case basis. As an option, they are able to offer a theft guarantee which offers protection against intrusion and burglary. However, to be able to access this guarantee, insu

Home insurance is tacitly renewable coverage. This means that when its anniversary date arrives, it automatically renews to ensure continuity of protection. However, sometimes the insurer terminates the coverage, most often due to non-payment or following multiple claims. When an insurer terminates

A second home is not immune to the same risks as the main dwelling. In this context, it is imperative to take out home insurance that covers any claims. How to subscribe to such coverage? What guarantees must be included in the contract? Answers. Secondary home insurance:an obligation? A secondary

If you are the tenant of a furnished or unfurnished apartment or the owner of a condominium, you have a legal obligation to take out home insurance. This coverage runs throughout the period that you are responsible for the property. However, it happens that during this time your situation changes o

Students and young people are the most fond of shared accommodation, because it allows you to divide the cost of rent between each occupant to save money. To stay in good standing with the law, roommates must take out home insurance. What are the particularities of this contract? How much does it co

Furnished apartments or houses are particularly interesting for tenants, because they no longer need to purchase furniture. This type of accommodation is ideal for students, people looking for a temporary place to live while waiting for the end of work or construction or those who are passing throug

Being in possession of a property requires taking all the necessary precautions to preserve the heritage. Thus, even if the accommodation is unoccupied, the owner must take out home insurance so as not to have to suffer alone the financial consequences resulting from a disaster. The question now ari

Since home insurance is compulsory for owners and tenants, the market has become particularly dense in order to meet the needs of all these policyholders. The hardest part for a consumer will be to find the best contract that will offer him optimal coverage at the fairest price. To achieve this, he

Since home insurance is compulsory, there is a profusion of offers on the market. The most difficult will be to identify the best contracts combining competitive prices without compromising on the quality of the guarantees. By using certain criteria and the right techniques, it is easier to find the

To protect yourself against disasters that may occur in a home, taking out home insurance is vital. Moreover, this coverage is mandatory for all tenants and condominium owners. To be sure to benefit from the best protection, you still have to know how to choose the right guarantees. Focus on those t

Home insurance is compulsory for owners and tenants. This is a recurring expense for the persons concerned which they cannot avoid as long as the property is under their responsibility. In this context, it is important to opt for a reasonably priced contract offering the most protective guarantees.

To continue their studies, young people must leave the family home and rent new accommodation. Whether he decides to settle in a university residence, in a Cité U or in a private apartment, the student is subject to the obligation to take out home insurance as a tenant. Since this is a recurring cha

Due to a lack of sufficient liquidity, most borrowers take out a loan to buy real estate. In some cases, it may be more attractive to borrow even when the buyer can pay cash. Some borrowers plan to pay for their property in cash by mobilizing all of their savings. Is this the correct solution? Expl

Members of the public service can take advantage of advantageous conditions to carry out a real estate project. Indeed, their status allows them to benefit from loan insurance at a reduced rate. Some banking establishments have entered into agreements with civil service mutuals providing for specia

The home loan is accompanied by other mandatory expenses such as notary fees, application fees and borrower insurance. The latter can represent up to a third of the total cost of the loan. Home loan insurance covers the borrower and his family in the event of death, temporary or permanent disabilit

While the number of permanent contracts is falling and most hiring is on fixed-term contracts, banking establishments are making some efforts and sometimes give executives on fixed-term contracts a chance. The status of civil servant is privileged with banks because it benefits from job security. T

Including one or more consumer loans in a home loan is possible thanks to the grouping of loans. Redeeming your home loan or consumer loans is a frequent operation. It has even become essential for owners who can currently take advantage of particularly low interest rates. Why combine a real estate

4 key ideas to help your passion business take off quickly!

4 key ideas to help your passion business take off quickly!

How to insert symbols and special characters in a Google spreadsheet

How to insert symbols and special characters in a Google spreadsheet

How to disable OneNote from pasting source links

How to disable OneNote from pasting source links

Everything You Need to Know About Starting an SEO Business

Everything You Need to Know About Starting an SEO Business

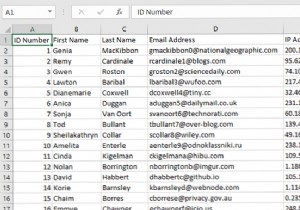

How to merge and unmerge cells in Excel Tips and tricks to know

How to merge and unmerge cells in Excel Tips and tricks to know