Managing your money well is extremely important, but it can be quite tricky. 6 Easy Tools For People Who Hate Managing Finances 6 Easy Tools For People Who Hate Managing Finances Hate managing your finances? Does writing a budget fill you with dread? Take a look at these simple tools that make the process much easier and more fun. Read more . To lighten that load, try helpful templates with built-in calculations. These spreadsheet templates come with categories so you can get started quickly. In addition, they are editable, allowing you to adapt them to your needs.

For even more money management templates, be sure to check out these top 10 spreadsheet options 15 Useful Spreadsheet Templates To Help Manage Your Finances 15 Useful Spreadsheet Templates To Help Manage Your Finances Always make a track your financial health. These free spreadsheet templates are just the tools you need to manage your money. Read more.

For a clean and neat way to track your personal expenses, try this template. The workbook includes three sections for a dashboard, expense log, and category settings.

You can get a clear picture of your spending with the dashboard. The interactive chart allows you to apply filters to view expenses by month, category, or subcategory. The expense log is where you enter each item with the date, category, subcategory, amount, and an optional note.

Those transactions will automatically show up on the dashboard. The category settings area is prepopulated with common categories and subcategories, but you can easily edit it.

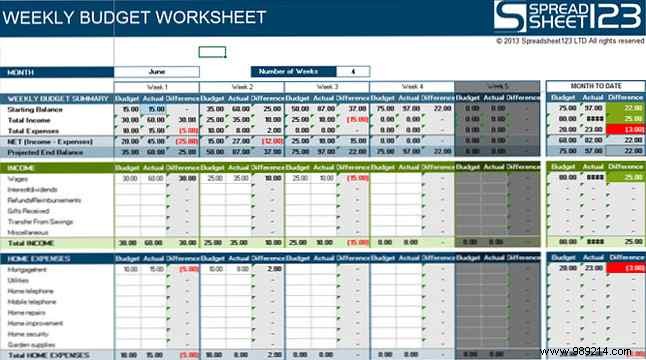

While many people work on a monthly budget, you may prefer to manage your money on a weekly basis. This workbook includes weekly and bi-weekly templates for an entire month. Plus, you can view handy month-to-date totals.

The top portion of the template gives you a quick look at your projected income, expenses, and ending balance. These amounts are automatically populated based on your entries below it. You can enter various types of income, such as wages, interest, and gifts.

Then scroll down to your expenses, which are nicely separated by category. These categories include household, health, transportation, and subscription expenses.

The Money Tracker template works in Microsoft Excel on your desktop as well as on your mobile device. While it's intended to help teens and young adults easily manage their money, anyone can use it.

You can manage your cash, checking account, credit account, and savings in one workbook. As you enter transaction amounts, the balance at the top adjusts for each section.

You can change the categories used in the book settings area along with payees, credit accounts, and savings funds. Then when you add transactions, you simply select one from the list.

If what you really need is a comprehensive and detailed home budgeting tool, this template is for you. Simply enter your income and expenses to manage your household budget 7 Useful Excel Sheets to Instantly Improve Your Family Budget 7 Useful Excel Sheets to Instantly Improve Your Family Budget Setting up a family budget isn't always easy, but these seven templates will give you the structure you need to get started. Read more on a monthly basis.

The part at the top shows net income minus expenses along with forecast and actual ending balances. Once you enter income from work, gifts, or interest, then you enter your expenses so that the top part fills in.

You'll notice that expenses are conveniently classified by deductible and non-deductible. With many categories, from business and charity expenses to daily living and utilities, this is a useful spreadsheet to manage your money by month.

If you want to take a close look at your credit account and make sure things match up when you get your statement, this template is for you.

You can easily get started by entering your credit limit and percentage at the top. Then simply enter the transactions along with the dates, descriptions, categories and amounts below. You can also add a label or note, and an R or C to indicate reconcile or delete, respectively.

You can see your ending balance after each entry and view a category summary. You can also open the settings tab to change categories and payees if needed.

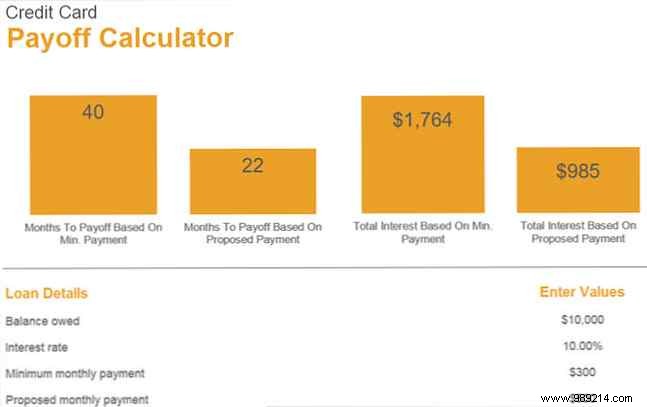

To find out when that credit card will be paid off, use this handy calculator. Just enter the balance due, interest rate percentage, minimum monthly payment, and proposed monthly payment.

You will then see how many months it will take to pay off the credit card by making only the minimum payment compared to the proposed payment. You can also see the total interest amount you'll pay based on the minimum payment and the proposed payments as well.

This is a great way to adjust the proposed payment amounts based on your budget so the card pays off quickly.

If you have more debt than just a credit score, this calculator is a great tool. Just Add Credit Card, Car Loan 5 Calculators To Decide If You Can Afford A New Car Or House 5 Calculators To Decide If You Can Afford A New Car Or House Getting a loan can be a complicated procedure, but determining if it's a good idea in the first place it can be even more difficult. Read more, and student loan details, choose a strategy, then view the payment schedule.

First, fill out the creditor information table, and then select your strategy from a variety of options. You can choose Snowball, which starts with the lowest balance first, or Avalanche, which is the exact opposite. You can also use the order shown in the creditor information table or create a custom strategy.

Then, go to the payment schedule sheet to see all the details depending on the strategy you choose. The key to success with this debt reduction calculator is to stick to that schedule.

When you want to get a general idea of what funds will be needed when you retire, check out this planner. This can help you start preparing and get a good idea before you talk to an advisor.

Start by entering your current age and retirement age. Next, enter your sources of income followed by housing, personal, living, and medical expenses.

The summary at the bottom will adjust based on your entries. This shows you the required annual income, the estimated income, and the annual income shortfall.

If you need to plan one or more events How to use Google Keep to plan almost any event How to use Google Keep to plan almost any event Have a big event to plan? Google Keep can help you share planning, mark materials, and have a safe place to organize everything without worry. Read More The workbook includes sheets for a camp event, seminar, and bike race. However, these are basically examples that you can use and edit to suit your event.

Enter a description, select a category, and add an amount and unit cost for each expense. As you do this, you'll see the area at the top adjust to give you a summary. You can review the budget summary as well as expenses with income in a neat graph. You'll also see expenses broken down by category. This is useful if you have a strict budget for certain items like location or supplies.

When the event you're planning is a wedding, weddings are stressful:12 websites for stress-free planning Weddings are stressful:12 websites for stress-free planning Although wedding planning will never be easy, it certainly doesn't have to be easy. what to be stressful. How much easier wedding planning can be if someone points you to the right tools. Read More All the necessary categories, from simple ceremonies to extravagant weddings, are already in this template for you.

This book uses two sheets to budget for your wedding. The first is the wedding budget information sheet. You'll enter your contribution amount and then the amounts for each item, from clothing to decorations. Those amounts are automatically populated on the budget estimator sheet.

The goal is to stay within the estimated amounts and you will see any variances on the wedding budget sheet. This will allow you to easily see where you can cut corners if needed.

When it comes to managing your money, having the right tools is essential. 15 Great Tools for Easy Tracking and Budgeting. 15 Great Tools for Expense Tracking and Budgeting. Keeping track of your expenses and budgets are two fundamental aspects of having a good financial situation. These 15 apps make it easy to do both. Read more . Whether it's a long-term plan to pay off debt or a short-term budget for an event, these templates give you easy ways to manage those finances.

Is there a financial spreadsheet template you were hoping was on this list? If you're looking for one in particular to help you with your money, let us know in the comments!