As an employee, you have many rights and obligations. You will find a lot of essential information about your rights and obligations as a worker, as well as advice for your career or for your personal development.

It is not always easy to find your way around when you start asking questions about your retirement, especially since the reforms have been taking place for a few years. However, there is a simple, free process, open to employees and business leaders, which allows you to take stock of your situation

The taxation of compensation received upon retirement depends on the terms of the latter. Depending on whether it is a voluntary departure, a departure within the framework of a social plan or retirement by the employer, these end-of-career indemnities are subject to different rules in income tax an

It is estimated that more than one million French people live abroad after retirement. Their proportion has doubled in the space of ten years. Many of them stay in Europe, in Portugal in particular, but a certain number choose more distant destinations such as Morocco, overseas territories or Maurit

The pension quarter buy-back concerns people who have not contributed long enough to obtain a full-rate pension. A solution often more advantageous than those proposed in this case, that is to say either continue to work to acquire quarters, or accept a discount on his pension. Buying back a quarter

The invalidity pension is paid by Social Security to private sector employees who can no longer exercise an activity due to an accident or a non-occupational disease, and who therefore see their income from work drop. This pension compensates for this loss of salary. The self-employed and civil serv

Like all employees in the private sector, non-permanent agents of the State and public authorities depend for their basic pension on the general social security system (Cnav). With regard to their supplementary pensions, they are attached to the Supplementary Pension Institution for Non-Permanent Ag

The minimum legal retirement age in France is now 62 for all people born from the 1st January 1955. This is the age from which you are authorized to cease your professional activity. However, it does not guarantee that you will then receive a full pension. It all depends on how many quarters you hav

The Retirement Savings Plan (PER) is a savings product created in 2019 which has gradually replaced all other retirement savings products that previously existed such as the Popular Retirement Savings Plan (Perp), the Madelin contract (Contrat d savings plan for self-employed workers), the collectiv

A retirement bonus, often called a severance allowance, is paid to private sector employees who cease their professional activity because they meet all the conditions for retirement. The calculation and amount of this bonus differ depending on whether the employee leaves voluntarily or whether his e

If you have experienced periods of unemployment during your professional life, rest assured, the period of time you have been unemployed is in principle taken into account for your retirement. One downside, however, is that your periods of unemployment count differently depending on the years during

The acronym Carpimko stands for the Autonomous Pension and Provident Fund for nurses, physiotherapists, speech therapists and orthoptists. This is the organization that manages pensions in particular, but which also has social missions, of all liberal medical auxiliaries. What is Carpimko? What are

The old-age allowance fund for general agents and non-salaried insurance and capitalization agents (CAVAMAC) is the body that manages, on behalf of the National old-age insurance fund for the liberal professions (CNAVPL), the retirement of general insurance agents and fully supports the supplementar

The Pension Fund for Chartered Accountants and Statutory Auditors (Cavec) is the pension fund, but also the mandatory provident fund for chartered accountants and statutory auditors, as its name suggests. This fund manages their basic pension plan and that of their supplementary pension. Cavec enjoy

All employees or the self-employed can ask to retire on the date of their choice from the moment they have reached the legal age, i.e. 62 years old. The retirement starting point must correspond to the first day of a given month. However, requesting retirement requires a period of instruction for it

The Interprofessional Pension Fund for the Liberal Professions (CIPAV) is, as its name suggests, the pension fund, but also provident fund and social action, of a large part of the liberal professions. This fund manages their basic pension plan and that of their supplementary pension. What is the C

In principle, someone who has never worked cannot receive a retirement pension. Indeed, it is by having a salaried or self-employed activity that we contribute to old-age insurance. These contributions are deducted from our salary or earned income. They are then translated into quarters or points wh

Few people know it, but the pension funds of the basic and supplementary scheme can provide their affiliates with assistance, particularly in terms of housing. From information to prevention, via technical or financial assistance for fitting out ones home, among other things, these organisations, th

After the age of 65, people with low incomes can benefit from the minimum old age. This is an allowance paid monthly, subject to means in particular, intended to guarantee the elderly a minimum monthly income. What is the minimum old age? Once retired, all employees receive a pension calculated on

Break-up assistance (Asir) refers to one-off assistance that can be paid to retirees in the event of an exceptional situation, known as a “break-up”, such as the death of a spouse, for example. This aid is intended to improve living conditions both from a material and psychological point of view. Th

On the death of a married person, his spouse is entitled to the payment of a survivors pension paid by Social Security or the special scheme on which he was dependent if he occupied an agricultural, liberal, craft, commercial or religious activity. Conditions are required to obtain this pension. Who

Becoming a nanny:idea of additional salary for retirement

Becoming a nanny:idea of additional salary for retirement

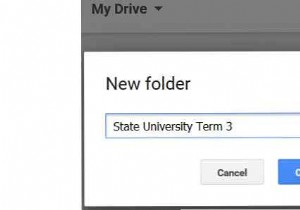

How Google Drive can help you stay organized as you head back to school

How Google Drive can help you stay organized as you head back to school

What are the essential guarantees of home insurance?

What are the essential guarantees of home insurance?

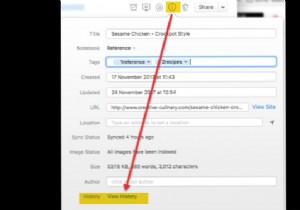

How to backup and restore your Evernote notes

How to backup and restore your Evernote notes

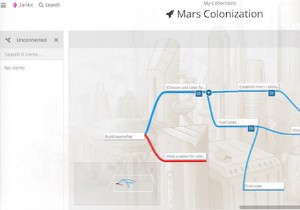

The Trello killer transforms your Kanban board into a to-do list and calendar with Zenkit

The Trello killer transforms your Kanban board into a to-do list and calendar with Zenkit